Urjit Patel says ‘lack of timely action by government stoked bad-loan problems’

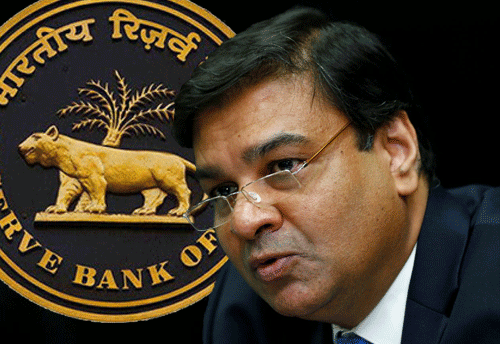

Urjit Patel.

Urjit Patel.

Former governor of Reserve Bank of India, Urjit Patel, in his first public appearance since his abrupt exit from the central bank as its governor in December 2018, gave a presentation at Stanford University’s annual conference on Indian economic policy on June 3-4.

While touching upon various issues such as bad loans, bank regulation and bankruptcy resolution, Patel, whose presentation was released on Thursday, said, “India’s bad loan problem slowly morphed into a full-blown crisis due to a lack of timely action by regulators and the government for several years until 2014, and it was largely driven by state-owned banks.”

He added, “The government banks are nudged to (over-)lend to pump prime the economy/boost preferred sectors. But this leads to higher NPAs over time, which requires equity infusion from the government, and this eventually adds to the fiscal deficit and sovereign liabilities (eg, on account of recap bonds) in due course, anyway.”

Patel also said, “The government and regulator face a trilemma: Not possible to have dominance of government banks in the banking sector, retain independent regulation, and adhere to public debt-GDP targets.”

Leave Your Response