With eye on 2019 Lok Sabha election, government raises GST exemption ceiling from ₹20 lakh to ₹40 lakh

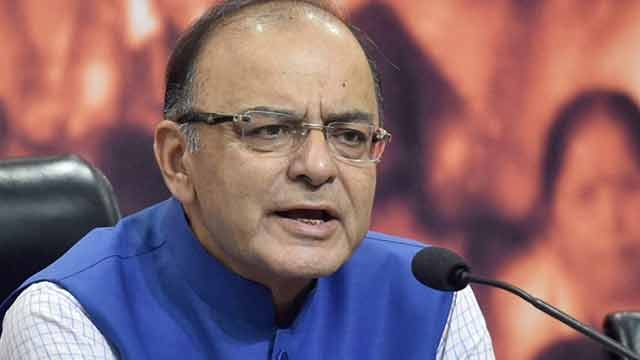

Arun Jaitley.

Arun Jaitley.

New Delhi: In order to give a relief to the small business just before the upcoming Lok Sabha election, the GST council, on Thursday, approved the doubling of the annual turnover exemption limit for the goods and services tax composition scheme. The new exemption limit threshold under the goods and services tax is ₹20 lakh from ₹10 lakh for the northeastern states and ₹40 lakh from ₹20 lakh for the rest of the country.

And the annual turnover for availing composition scheme has been increased from ₹1 crore to ₹1.5 crore, which will come into effect from the April 1. The states however will have the option to choose the two options of ₹20 lakh and ₹40 lakh and they will have to take the decision within a week.

The council also allowed Kerala to impose a 1 per cent disaster tax on intra-state sale of goods and services rendered for a period of two years to boost revenues in order to meet the costs of rehabilitating parts of states that were affected by the 2018 floods.

The estimated revenue loss on account because of the hike in exemption under GST to ₹40 lakh will be around ₹5,200 crore, assuming almost 50 per cent of the taxpayers will go out of GST. Rest 50 per cent however are expected to stay within the indirect tax regime to take the supply-chain benefits under GST.

The finance minister, Arun Jaitley, said that the GST composition scheme under which the small businessman pays 1 per cent tax according to their turnover, will also be extended to service providers up to a turnover of ₹50 lakh at a tax rate of 6 per cent.

The finance minister further stated that the small companies would have the option to opt out of the GST tax net.

This is going to give some relief to small and medium enterprises, who have been burdened with GST. The government is attempting to placate the SME/MSME community before the general election.

Leave Your Response